Janssen Malloy is pleased to announce that Frank Martin has joined our firm as our newest associate. Mr. Martin recently graduate from the University of the California Davis School of Law. During law school, he completed an internship in the Misdemeanor Department of the Sacramento County Office of the Public Defender and also clerked for the Third Appellate District Court … Read More

SEEKING INFORMATION REGARDING THE CARE AND TREATMENT OF RESIDENTS OF TIMBER RIDGE AT EUREKA

We represent the family of a former resident of TIMBER RIDGE AT EUREKA who died in her apartment after exposure to extreme heat in January of 2022. If you are a current or former resident, family member of a current or former resident, or a former employee of Timber Ridge at Eureka and you have any information regarding the … Read More

SEEKING INFORMATION REGARDING THE CARE AND TREATMENT OF RESIDENTS AT TIMBER RIDGE AT EUREKA

We represent the family of a former resident ofTIMBER RIDGE AT EUREKAwho died in her apartment after apparent exposure to extreme heat.If you are a current or former resident, family member of acurrent or former resident, or a former employee ofTimber Ridge at Eureka and you have anyinformation regarding the care and treatment of residents,please contact:Attorney Megan Yarnall orParalegal Karen … Read More

Tenant Protection Act of 2019 Remains a Minefield for Landlords

Passed in 2019, Assembly Bill (AB) 1482, the Tenant Protection Act, imposed statewide rent control and limited evictions to specific categories of “just cause” for most residential rental units. It also requires landlords to offer relocation assistance, either in the form of a check to the tenant or a waiver of one month’s rent, in cases where the “just cause” … Read More

5.0 Star Review of Patrik on AVVO

First interaction with any attorney and couldn’t be happier. Patrik was kind enough to assist with an unemployment issue and the outcome was successful. Would not hesitate to hire him again. Shari See all of Patrik’s Reviews on AVVO

Civil Litigation Paralegal, Legal Secretary

The Janssen Law Firm is growing. We are looking for talented employees to join our team. We are a ten-lawyer Humboldt County law firm, primarily handling plaintiffs’ personal injury, nursing home litigation, real estate law, business transactions, estates and trusts, criminal defense, and health care law. Our firm is top-rated on AVVO, and we have won numerous awards for trial … Read More

New Vendor for CURES: Submitters Must Report by February 9, 2022

The State of California has changed its CURES vendor, and all providers who upload information to CURES must use the new vendor for reporting dispensation data as of February 9, 2022. Information about how to change your access as a submitter to CURES is being disseminated by the California Department of Justice, and you can find more information here: https://oag.ca.gov/system/files/media/3rd-notice-data-collection-vendor-change-011822.pdf

Procedural Hoops When Suing the Federal Government

When the federal government (or one of its agencies) is the defendant, strict compliance with the Federal Tort Claims Act (“FTCA”) is required. The FTCA is the exclusive money damages remedy for negligent acts or omissions of federal government employees acting within the scope of their federal employment (28 USC section 2679). A current Janssen Malloy LLP case illustrates the … Read More

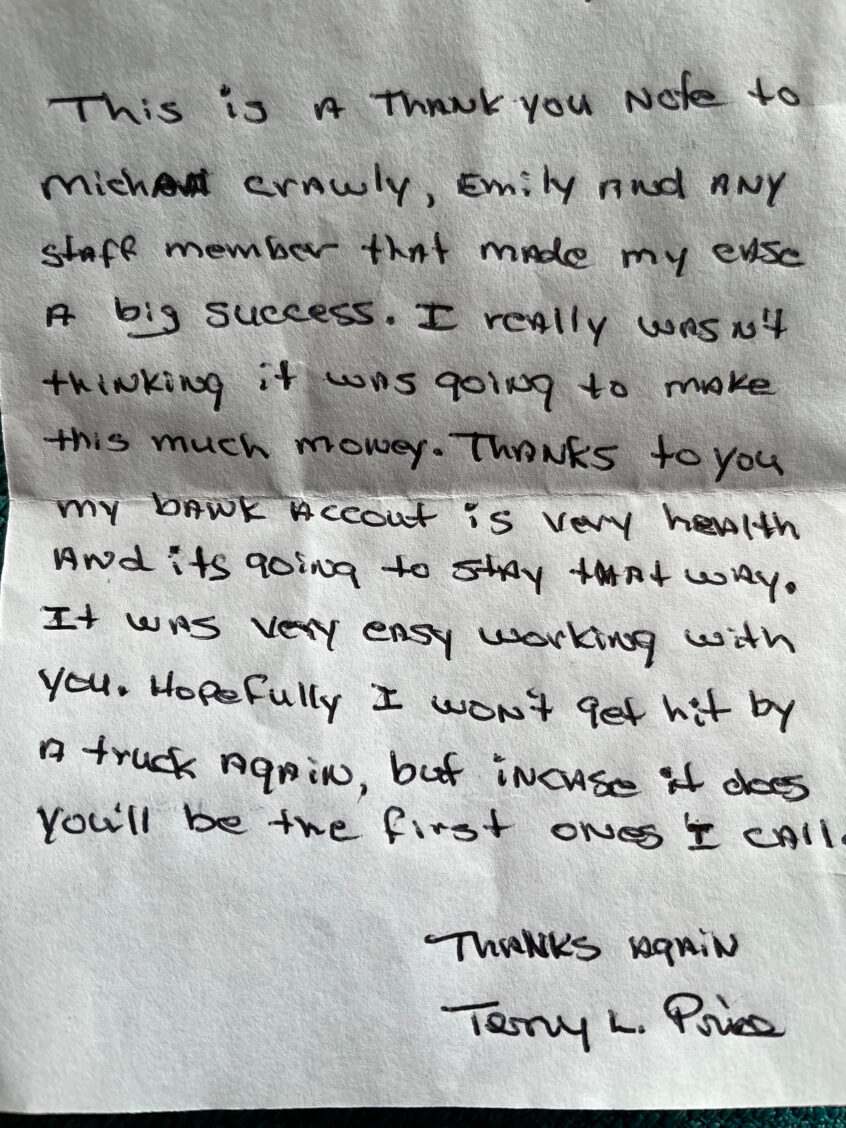

Janssen Malloy LLP Recovers $150,000 Combined Policy Limits in Oregon Collision Case

Janssen Malloy LLP recently obtained a combined $150,000 policy limits recovery for an couple injured in a head-on collision near Brookings, Oregon. Janssen Malloy LLP partners Michael Crowley and Megan Yarnall handled the matter. Dennis and Trudy Hunt, on their way to move into their just purchased home in Brookings, were struck head-on by a motorist driving a pickup truck … Read More